UmbrellaX - Delegator Liquid Staking Pool Token

WEB3.0 INDUSTRY CURRENT PROBLEMS

➡ Many Web3 users lack the insight to optimally strategize their portfolio

➡ Web3 users need a way to simplify the general process of purchasing crypto

➡ A Decentralized vehicle to gain exposure to top cryptocurrencies is needed

➡ Web3 users need a way to analyze risk management within the Web3 market

Why Choose UmbrellaX Web3.0 ? (USP Propositions )

➡ UmbrellaX offers a variety of indexes that are based off of risk models,aiding in assessing various Risk appetites

➡ With our cutting edge technology, we have done extensive due diligence and market research to ensure we deliver the best indexes for our community

➡ UmbrellaX offers a variety of indexes that are based off of risk models, aiding in assessing various risk appetites

➡ Index portfolios streamlines the process of broadening the exposure to a wider Web3 market

➡ UmbrellaX empowers users with our community weighted index, gathered from the knowledge of our experienced supporters

Technology Behind UmbrellaX Web3.0

Defi Index Broad Exposure, One Token

➡ Our Indexes Track the progress of the Entire Digital Finance Space. UmbrellaX offers quick and easy exposure through one token, simplifying upside to the fastest growing sectors in DeFi.

UmbrellaX Liquidity Fund Token

➡ A collection of index baskets, including DeFi, blue chip, NFT, gaming, zk rollup, to name a few. We offer portfolios to those of all experience levels and varying risk appetites.

Staking DAO Governance

➡ The UBX token allows voting rights to network participants. Tokens holders play an important role in the cultivation of the community-decided index and decisions relating to the Index Protocol.

Dynamic Fee Structure and Market Volatility Resistance

➡ Underlying assets included in the indices are selected by top market analysts with consideration to Market Capitalization, Volume, Kiquidity, and other key Indicators.

UmBrellaX

What is VDA Delegator Liquid Staking Token Fund Token ?

What is VDA Delegator Liquid Staking Token Fund Token ?

An index fund is a type of Mutual Fund with a portfolio constructed to match or track the components of a market index, such as the Standard & Poor's 500 Index (S&P 500).

This type of fund aims to buy a broad array of assets in line with its mandate in order to track the general trend of the markets.

An index fund provides broad market exposure, low operating expenses and low portfolio turnover.

These funds adhere to specific standards (e.g. efficient tax management or reducing tracking errors) implemented by predetermined rules that stay in place regardless of the current state of the markets

'Indexing' is a passive form of fund management that has been successful in outperforming most actively managed mutual funds.

The UmbrellaX VDA Index Fund offers investors a diversified exposure to the Web3 market through a single investment vehicle.

This fund is designed to simplify the process of investing in multiple Virtual Digital Asset, providing a balanced and risk-mitigated approach to Virtual Digital Asset investment.

What is a VDA Index Fund?

A Virtual Digital Asset index fund is a type of investment fund that aims to replicate the performance of a specific index of Virtual Digital Asset.

It allows investors to gain exposure to a broad range of digital assets, rather than investing in individual Virtual Digital Asset.

The index is typically composed of the top-performing and most liquid Virtual Digital Asset in the market.

➡Index Funds Vs. Actively Managed Funds

Investing in an index fund is a form of passive investing.

The primary advantage to such a strategy is the lower management expense ratio.

➡ Diversification:-

The fund includes a variety of Virtual Digital Asset to spread risk and reduce the impact of volatility in any single asset.

Exposure to top Virtual Digital Asset by market capitalization, including Bitcoin, Ethereum, and others.

➡ Professional Management :-

Managed by experienced professionals with expertise in the Web3.0 VDA Market.

Regular rebalancing to ensure the fund remains aligned with the index.

➡Transparency :-

Clear and Transparent fee structure.

Regular updates on fund performance and holdings.

➡ Accessibility :-

Easy entry and exit for investors.

Available to both individual and institutional investors.

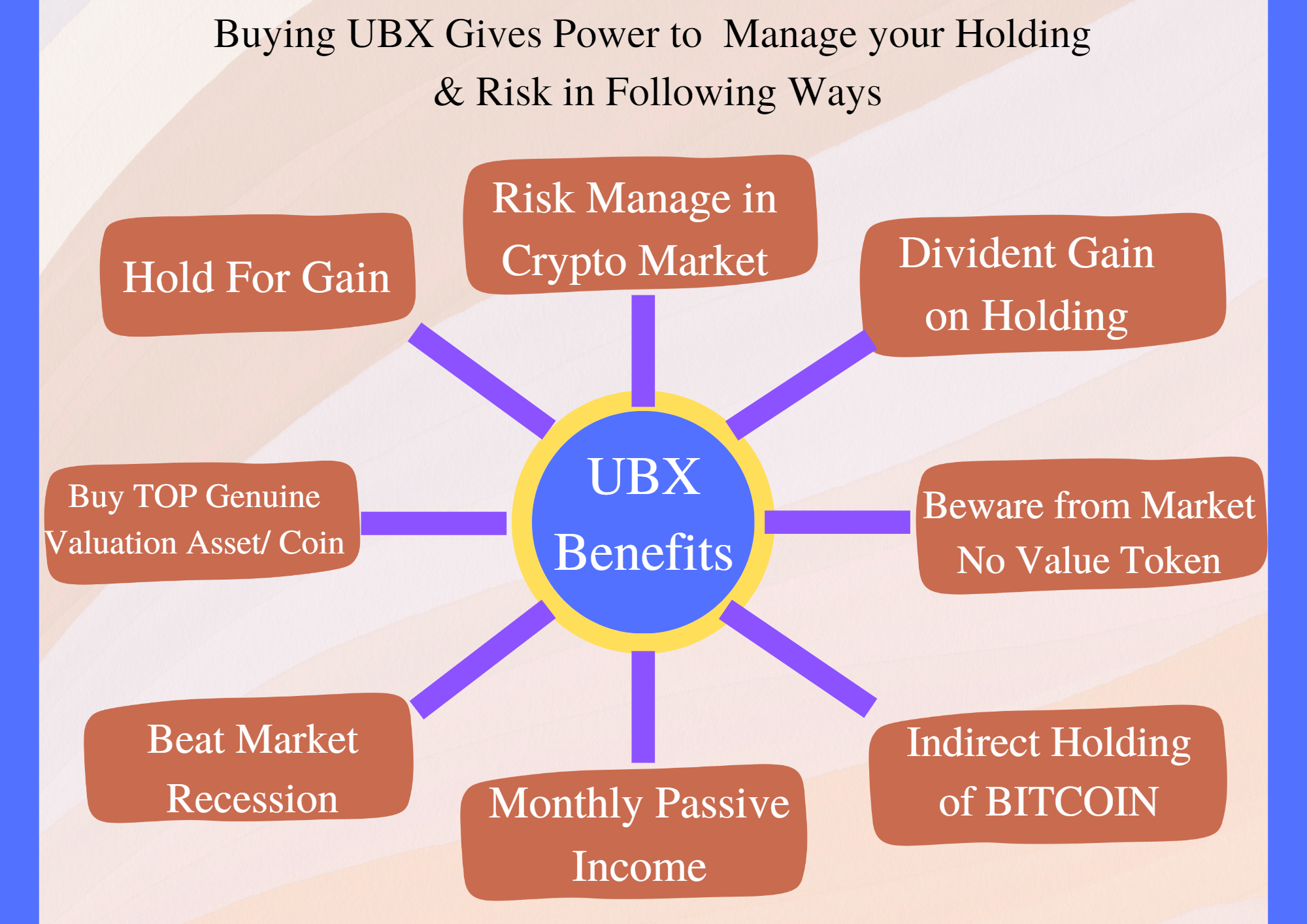

Benefits of Investing in the UmbrellaX Crypto Index Fund

➡ Risk Mitigation :-

Reduced risk through diversification across multiple Virtual Digital Asset.

Lower exposure to the volatility of individual assets.

➡ Cost Efficiency :-

Lower fees compared to actively managed funds. Reduced transaction costs by consolidating investments.

➡ Convenience :-

Simplified investment process without the need to manage individual Virtual Digital Asset holdings. Regular rebalancing and professional management.

➡ Performance Tracking :-

Ability to track the performance of the Virtual Digital Asset market as a whole.

Aligns with market trends and captures overall market growth.

How the UmbrellaX Crypto Index Fund Works

➡ Index Composition :-

The index is composed of the top Virtual Digital Asset by market capitalization and liquidity.

Regular reviews and adjustments to include emerging high-performing Virtual Digital Asset.

➡ Investment Strategy :-

Passive investment strategy aimed at replicating the performance of the index. Regular rebalancing to maintain alignment with the index composition.

➡Fund Administration :-

Crypto fund administration involves managing the operational and administrative tasks of cryptocurrency investment funds.

This includes a variety of functions such as accounting, reporting, compliance, and investor relations. Here are some key aspects of crypto fund administration:

1. Accounting and Financial Reporting

NAV Calculation: Net Asset Value calculation is crucial for assessing the value of the fund’s assets.

Financial Statements: Preparation of periodic financial statements in accordance with relevant accounting standards.

Audit Coordination: Working with external auditors to ensure the accuracy and reliability of financial statements.

2. Compliance and Regulatory Reporting

AML/KYC Procedures: Implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols.

Regulatory Filings: Ensuring compliance with local and international regulations, including filings with financial regulatory bodies.

Tax Reporting: Preparing and filing tax returns and ensuring compliance with tax laws.

3. Investor Services

Onboarding: Managing the process of bringing new investors into the fund.

Communications: Providing regular updates and reports to investors.

Distributions: Handling the distribution of profits to investors.

4. Fund Operations

Trade Reconciliation: Ensuring all trades are accurately recorded and reconciled.

Cash Management: Managing the fund’s cash flow and liquidity.

Risk Management: Monitoring and managing risks associated with the fund’s investments.

5. Technology and Security

Blockchain Integration: Utilizing blockchain technology for transparent and secure transaction recording.

Cybersecurity: Implementing robust security measures to protect digital assets and sensitive information.

Automation: Leveraging technology to automate routine tasks and improve efficiency.

6. Fund Structuring and Setup

Legal Setup: Assisting with the legal formation of the fund, including the drafting of necessary legal documents.

Jurisdiction Selection: Advising on the best jurisdictions for fund setup based on regulatory and tax considerations.

7. Performance Measurement and Reporting

Benchmarking: Comparing the fund’s performance against relevant benchmarks.

Detailed Reporting: Providing detailed performance reports to investors and stakeholders.

8. Custody and Safekeeping

Asset Custody: Ensuring that the fund’s digital assets are securely stored with trusted custodians.

Safekeeping: Implementing measures to protect assets from theft, loss, or unauthorized access.

9. Client Support

Dedicated Support: Offering dedicated support to address any queries or issues faced by investors.

Education: Providing educational resources to help investors understand the intricacies of Virtual Digital Asset/Coin investments.

Selecting a Crypto Fund Administrator

When choosing a crypto fund administrator, it’s important to consider their experience in the crypto space, technological capabilities, compliance expertise, and reputation in the market.

Conclusion :-

VDA fund administration is a complex and multifaceted service that requires specialized knowledge and capabilities.

Effective administration ensures that the fund operates smoothly, complies with all regulatory requirements, and meets the needs of its investors.

Managed by a team of experts with extensive experience in Virtual Digital Asset Markets.

Robust security measures to protect investor assets.

For the five-year period ending in 2023, 84% of large-cap funds generated a return less than the S&P 500.

In the 10-year period ending in 2015, 82% of large-cap funds Failed to beat the index.

Since the fund managers of an index fund are simply Replicating the performance of a benchmark index, they do not need the services of research analysts and others that assist in the stock selection process.

The extra costs of fund management are reflected in the fund's expense ratio, and are passed on to the fund’s shareholders.

Index funds are generally considered ideal core portfolio holdings for retirement accounts, such as individual retirement accounts (IRAs) and 401(k) accounts.

ExpertCash Flow to Index Funds

Due to index funds outperforming their actively managed counterparts on a large scale, asset flows have grown significantly in index fund products.

For the 12-month period ending May 2021, investors poured more than $875 billion into index funds across all asset classes.

Most of that money came at the expense of actively managed funds, which experienced outflows of roughly $308 billion during the same time frame.

UBX is One of the Top Virtual Digital Asset Index Fund Token. The first 'Token-as-a-fund'.

An easy way for anyone to get exposure to crypto returns with a broad, diversified risk.

| VDA Delegator Liquid Staking Pool Fund Token Name :-------- | UMBRELLAX |

| Token Abbreviation (Ticker):------ | UBX |

| UBX Smart Contract Address:-------- | 0xc2c6f75645438f1c68bd33228201accf0194cff5 |

| Decimals : - | 18 |

| Visit Official Site Url:------- | www.umbrellax.tech https://www.umbrellax.tech |

| Lightpaper :-------- | Lightpaper https://umbrellax.gitbook.io/ubx-vda-index-fund-token-lightpaper/ |

| Whitepaper:------- | Whitepaper https://umbrellax.gitbook.io/ubx-vda-index-fund-whitepaper-1.3/ |